Let’s face it: being in business can be tough. Especially when you are just starting, attracting potential customers can take up a lot of your time. Marketing takes time that you don’t get paid for, but it is necessary to make a living. Arguably, it is as much an art as anything else. After all, you need to convince people to buy your product or service, instead of meeting their needs through other means. Sometimes, it is hard to communicate the reason why your product or service is better for customers. Occasionally, you don’t even know what to tell them. Crowded markets can make consumer choices difficult, even confusing.

The importance of market research

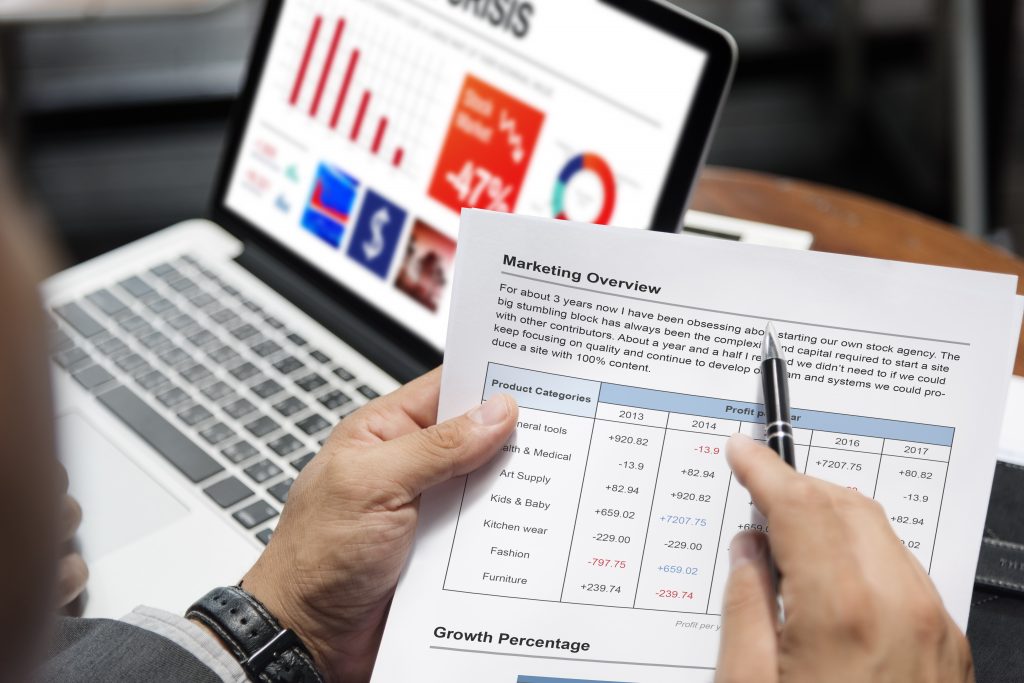

One thing that all businesses have in common is that they must stay ahead of the competition. Keeping ahead of the competition means that a company must conduct some market research. For small businesses, market research is especially critical because consumers are more likely to think about the more prominent brands in a market when making a purchasing decision. To reach potential customers, small businesses need to differentiate themselves from competitors. To help achieve this, you need to gather data on what consumers want. It is also useful for marketing purposes to know what your competitors are selling.

When doing market research, you need to be thorough. Doing research is the best opportunity you have to know what makes your business unique in the eyes of consumers. Customers often cite things like the product or service you provide, corporate values, or that personalized small-business feel. No matter your business, you need to remember that an essential aspect of market research is getting into the consumer’s head. Market trends change, and so do the needs of your customers, and unless you know what these are, you risk losing business to the competition. On the other hand, when armed with the right consumer insights, it is much easier to differentiate your business within its industry. Do it right, and customers will flock to your company.

Market Research Overview

When you think of market research, what is the first thing that pops into your head? For most people, it’s the customer survey. You know, those annoying emails, phone calls, and junk mail that ask for your opinion. As a consumer yourself, you might wonder why companies insist on irritating everyone with their constant questions.

However, being a business owner, you should look at these surveys in a different light. Companies derive essential data from these market research surveys, and it can help guide future marketing efforts. However, while surveys can be significant,, they are not the only aspect of market research. Instead, there are several types of market research, each characterized by different techniques. Your best approach to market research depends on the size of your company, which industry you are in, corporate goals, and how much you can afford to spend. Keep in mind that you should use more than one approach in the research process.

Let’s look at the three types of market research.

Quantitative Market Research

In essence, quantitative market research seeks to define the “cold hard facts” of the market. For example, what is the consumer most interested in buying right now? How much can they afford to pay for a particular product or service? Is there anything that consumers want that they can’t get, or that is too expensive for them to buy right now? What is a typical customer profile? From these facts and figures, marketers and product developers can gain insights into which direction they should go in to improve the product or a companies’ market share.

Quantitative market research can involve four main techniques:

Analyze internal sales figures.

Never underestimate the value of your internal data. If consumers are buying more of something you sell than something else, there may be a reason for that. Have something that’s always on backorder? Consider increasing the size of your production runs. Are you putting something on sale all the time? Maybe it’s time to discontinue the product. Of course, you want to make a careful analysis of this data before drawing too many conclusions. There might be other issues at stake. Also, you’ll want to try and find out why a particular item you sell is doing poorly, as there may be an opportunity for improvement.

Use Customer Questionnaires.

While internal data is valuable, you’ll never really know what customers think unless you ask them. It’s always possible that people are buying something because it’s the best product available, but that they aren’t happy with those options. Over time, this can result in declining sales as they find better products somewhere else. For that reason, your questionnaires should include satisfaction questions. Several types of surveys can be helpful. Either way, the data obtained can be beneficial to guide marketing efforts or identify ways in which your company can gain a competitive advantage. Just be sure that the questions you ask will yield the data you need.

Related Article: The Ultimate Guide to Marketing Strategies and How Best to Use Them

Ask your sales and customer service staff.

After all, they’re on the front line of your business. Your staff spends all day talking to customers. For example, sales staff are the ones who negotiate contracts and know what people are willing to pay. They’ll listen and respond when someone says they like something, but can’t pay that much for it, or they might ask about a particular feature that doesn’t exist yet. Keep in mind that these types of discussions happen all the time, and staff can tell you what the most frequent questions, comments, and complaints are.

If consumers continuously ask for something you don’t offer, there might be an opportunity to develop something new. If the price is a problem, then you might need to emphasize the extra value to customers in your marketing campaigns or determine a way to lower costs. Quality issues? Your customer service staff knows about them because people call to complain all the time. All of these insights are invaluable for your business.

Experiment with alternatives.

When you hear that term, you’re more likely to think of product development. However, that isn’t the only use of experimentation. Sometimes, it is hard to know what potential customers will think when presented with two or more specific options. For example, let’s say your company sells a variety of drink mixers. You’re trying to see which ones are more popular with consumers when they have the opportunity to try more than one out at the same time, so you set up a table in the local mall or grocery store and give out free samples. As people come by, you ask them to try out your products and ask which they prefer. This experiment will give a lot of valuable data. These numbers will help you plan for potential sales down the line, and even tell you which products might need improvement.

Qualitative Market Research

Unlike quantitative research, the qualitative research approaches focus on the “why” and the “what if.” When you are trying to identify market trends, for example, you’ll want to know what consumers want, what they think, and their reason for these opinions. Remember the iPhone revolution of 2007? When it was first released, companies questioned how much consumers would appreciate the multiple functions of this revolutionary device. After all, aren’t phones for calling people? They aren’t toys! These phones were so expensive that only the well-off could afford them and their premium data plans. Now, however, smartphones are everywhere. Consumers can choose from a large variety of devices and cell phone plans. In the meantime, Apple has made a bunch of money on its revolutionary product and everyone is always trying to keep up. How? With qualitative market research and cutting-edge product development.

In a nutshell, qualitative market research is all about determining what customers think about products, services, and ideas. It’s a more in-depth approach than quantitative research because the focus goes beyond an analysis of raw data. Instead, this type of study hopes to inform companies about how consumers might react to specific changes in a product line, for instance. These efforts might also help decide if a new product is commercially viable, or how an existing product can be modified to make it more marketable. Pricing considerations are another excellent area of study for qualitative research.

Let’s take a look at three of these techniques:

Focus Groups

Have you ever wanted to sit down with a few of your core consumers and brainstorm? Such conversations are one of the primary uses of focus groups. Although small, these discussions are excellent opportunities to find out what people are thinking. Questions can focus on new product ideas, or be intended to figure out what would encourage the purchase of a particular product. Other topics can include pricing insight or how to improve what is already on the market.

Focus groups are typically small, involving a dozen people or less. The key is to choose the right participants because you want the discussion to help predict actual consumer behavior. Generally, you want to hire consultants to conduct the study because they know best how to ask open-ended questions that yield the needed insights. They’ll give you a report detailing what consumer insight came from the discussions, and what conclusions they reached. Then, you can determine how to sell your products to the target market represented in the focus group. Just be aware that this isn’t the most effective market research technique if used on its own. You’ll want to include these discussions as part of a broader strategy.

Here’s A Practical Guide To Customer Satisfaction

Consumer surveys

Have you ever seen people out at the mall with clipboards, asking questions of people who walk by? Researchers might do this for a few reasons, but one of them is because they’re conducting consumer surveys. Over time, this has been one of the most effective and efficient methods of market research. These surveys can take several forms. For example, you could hire a company to do telephone surveys. Another option is to have paper questionnaires mailed to a particular segment of potential customers. Regardless of the type of survey you choose, the goal is to see what respondents think.

So, what kind of questions do these consumer surveys answer? Just about anything you want. Customers are quite happy to tell you about your product. If your product is too expensive, for example, they’ll often tell you. Or, you may be offering a great product, but the competition provides something better. If you decide to conduct a survey, choose the questions carefully but keep an open mind about what respondents have to say. It might be what you were suspecting all along, or there might be some surprises. You’ll never know unless you ask.

Observation

Sometimes you need the type of insight that isn’t easily gathered by asking consumers directly. That’s when hiring researchers to do observation can be helpful. Let’s say that your company sells baby strollers. Sales are falling, but the price doesn’t seem to be the issue because it’s in line with the competition. In addition to sending out surveys, you might send someone out to where a lot of mothers with children frequent. As you watch the mothers and children, you might find that those who are using a particular stroller have more difficulty using it than others. Maybe the wheel likes to catch in sidewalk cracks, or it is hard for mothers to collapse. These insights could help you improve the product, so it sells better.

Do people always use your products the way you expect they will? Maybe not. Think about paper clips. Their purpose is to hold a stack of papers together. However, this product is often used for a variety of unconventional purposes. For example, they can be looped through a broken zipper pull, used to hold a skirt or pants together, or even used to make jewelry. The manufacturer intends none of these uses, but everybody knows about them. Through observation, you may be able to gain insights to guide your marketing efforts that would’ve been inaccessible otherwise.

Secondary Market Research

While qualitative and quantitative market research usually consists of original studies ordered up custom by a company, secondary research profits from work already done. Perhaps the best part about secondary research is that it’s very cheap because you don’t have to bear the costs of an elaborate study. Often, you can find data of all types on the internet, especially when it comes to customer satisfaction. In very competitive markets, companies are always looking to use these types of data in their marketing materials. For example, the automobile industry participates in the JD Power surveys every year, with top-rated models bragging about it on television. Watch enough car ads, and you’ll quickly find out who won which awards this year. Their methods are well-known.

Secondary market research can take several forms:

- Checking Reddit: This is a social media site where consumers discuss products and services. In the case of Reddit, users remain anonymous while talking about the things that they care about. Such discussions can include feedback about things people have used and help identify market trends. You also can gather data about what potential customers want or need. Finding relevant content has never been easier.: That’s because Reddit has a search tool based on keywords. With a little bit of trial and error, you should be able to find a wealth of information.

- Read your competitor’s website: It’s never a bad idea to see what your competitor considers to be its’ best product. Companies are all too eager to tout the merits of what they’re selling. Don’t neglect annual reports, either; if your competitor is publicly traded, they have to release their financial figures. However, regardless of the data you gain from the competitor, don’t forget that it isn’t unbiased.

- Monitor reviews: Depending on your industry, there are a wide variety of websites that post reviews. For the service industry, Yelp is very helpful. When consumers have especially good or bad experiences, they’ll often share them for everyone else to read. Another useful resource is the Better Business Bureau.

- Check for third-party studies:: In addition to competitors, a lot of other parties are doing research that may be relevant to your business. For example, psychology students might do a study on consumer behavior that can help you shape a survey. This study might be published on the internet, or in an online journal. Likewise, governments do their own studies that help them with regulatory decisions. Remember, if it’s online, you can often access it for free or at a low cost. You never know what you might find.

Choosing the Right Approaches for Small Business

As a small business owner, you may be wondering how to choose the right market research techniques. After all, you probably have a limited budget, and it is easy to feel overwhelmed with choices. Which techniques are the best depends on a variety of factors that are specific to your business? Let’s take a look at some of them.

Goals of your research

Are you considering a new product rollout? You might be interested to know what the potential market is for this item. Customer interviews, surveys, and focus groups are a great way to get in-depth information about what the market wants. This is also true when redesigning your product. Let’s go back to the iPhone; although it now has many competitors, it remains a consumer sensation. As part of the process of development, Apple is careful to monitor end-user behavior to predict how they would react to a given change.

On the other hand, if you’re trying to improve customer service or your sales pitch, secondary research can go a long way. After all, it helps to know what people are saying they want online, or if they’re upset about something. Some companies even penalize their staff for excessive bad reviews. Either way, you’ll learn a lot.

Budget considerations

Hoping to gain actionable insight but don’t want to go broke in the process? Choosing the right technique can help. Some options are low-cost, while others will cost a pretty penny. For example, surfing the web to find reviews generally doesn’t cost anything. On the other hand, paying for a bunch of telephone surveys is a significant expense. Find the right balance between costs and goals, and your business will have a lot to gain.

Conclusions

Being a small business owner is a lot of work. From marketing your product to making it better, there’s always a lot of work to do. At the same time, your competitors are always trying to get ahead of you. No matter your industry, market research is critical for winning in the marketplace.

What’s your favorite market research technique? How did it help your business? Leave a comment below.